Getting startup fundraising is a big step and an exciting but difficult period that might affect your company’s future.

Driven and innovative business owners look for grants, loans, investors, and other financial sources at this time to provide their companies the money they need to develop new goods, integrate new features, and spur expansion.

Let’s investigate the exciting realm of startup finance, where businesses establish themselves and realize their potential.

Join us as we break down the different kinds of funding, describe the financing stages, and offer practical guidance for surviving this exciting stage of your business journey.

So fasten your seatbelts and join us as we go on an adventure that blends the thrill of discovery with the strategic agility needed to overcome startup funding obstacles.

What Is Funding for Startups?

The capital needed for startups is what turns creative concepts into profitable ventures. The critical capital infusion that transforms startup companies from tiny sparks into booming corporations.

This money is sourced from a number of places, such as product development, venture capitalists, angel investors, and personal savings. It pays for important things like team building, marketing, product development, and even operating costs.

It helps entrepreneurs reach their goal of changing the game by guiding them through the challenging early growth phase.

One thing is certain, though: bright entrepreneurs may overcome obstacles and take the world by storm with their disruptive inventiveness provided they are given the correct financial adrenaline shot.

Understanding the various fundraising stages and selecting the appropriate source is crucial.

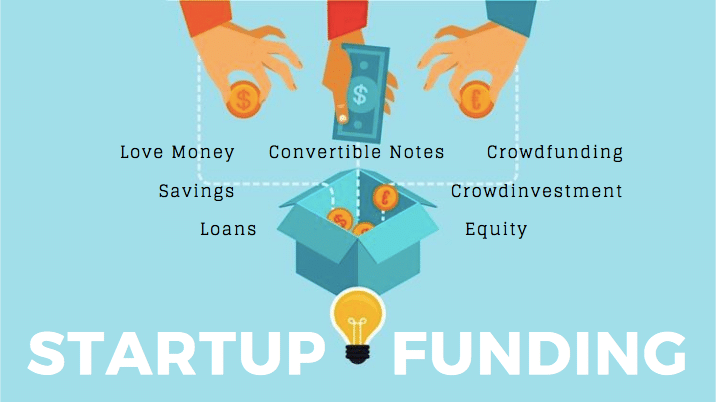

Types of Funding for Startups

Independent Funding

- Bootstrapping is a controversial yet effective business approach where entrepreneurs fund their companies entirely via sales or their cash, without the need for outside financing.

- Credit cards are a common, albeit risky, way for 17% of businesses to cover their startup expenses. Prudence is advised due to potential interest rates and fines.

- Startups can reduce operating costs by using a creative tactic called bartering, which involves swapping goods or services for cash to cover basic expenses.

Using crowdsourcing

- Online startup funding platforms: Crowdfunding is the process of raising money on sites where business owners may already have an audience or may need to build one. At every step of the process, transparency on the state of the company is crucial.

- Closed ones: One popular but effective method entrepreneurs use to support their endeavor is to ask close friends and family for money.

Credit

- SBA Microloan: Through microloans, the U.S. Small Business Administration offers start-up companies up to $50,000 in operating capital.

- Microlenders: These are businesses that offer small loans, often between $5,000 and $50,000. The greatest option for business owners who might not qualify for conventional corporate loans is to use microlenders.

- Personal Business Loans: People with good credit and stable resources may be able to get personal business loans to finance their initial operations.

Grants

- Small Business Grants: Governments, companies, and nonprofit organizations all provide small enterprises with free capital. Grant contests may be fiercely competitive, underscoring the need for alignment with the goals of the organization.

Private Equity Companies

- Because venture capital requires large outlays, it is best suited for companies that are ready for quick development. Nevertheless, securing venture funding is difficult and takes time.

- Angel investors give their money to businesses in exchange for shares or other ownership positions, as opposed to typical venture financing.

Accelerators & Incubators

- Prominent programs assist business owners in starting their ventures; accelerators speed up growth, while incubators focus on company development.

- These offer financial support, connections, and coaching—all of which are advantageous, particularly for aspiring entrepreneurs.

How does Funding for Startups Operate?

Equity is often sold as a corporation expands to ensure investors receive a return on their investment.

The process usually consists of seed rounds and investment rounds A, B, and C, each of which plays a different role in the development of a company. Now let’s talk about the fundraising rounds:

Before Seeding: As the company develops, friends, family, and personal savings provide the first round of capital.

Seed Capital: A formal equity-linked funding round that finances initial phases like audience growth, launch, and product development.

After seed money is used to develop a product, build a customer base, and formulate a long-term growth plan to expand product offerings, Series A investment takes place.

Series B Capital: Focuses on business growth while supporting recruiting, sales, marketing, tech development, and customer service.

Series C Investment: Successful entrepreneurs need more funding to create new products, acquire competitors’ companies, penetrate new markets, establish executive teams, and prepare for an IPO.

Series D Investment: Typically, they comprise well-established companies seeking a final push of capital to reach certain objectives.

Some Advice on Getting Startup Fundraising

- Calculate the precise amount of capital needed to support your company’s objectives, taking grants, loans, and equity financing into consideration.

- Make a thorough business plan including your goals, marketing tactics, schedule, and competition research to entice lenders, investors, and supporters.

- By compiling the required paperwork, generating profit and loss accounts, and forecasting future costs to determine the funding gap, you may better understand your present financial situation.

- Consider the many funding sources available while considering the unique requirements and objectives of your company. To make well-informed judgments, much study is required.

- If you choose to finance your project with loans or equity, have a clear payback plan in place. Make sure your projected payments stay inside your budget by calculating them with business loan calculators.

End Note

It’s thrilling to launch a business, but without sufficient capital, your amazing concept can stay just that—an idea.

Getting funding for your startup requires more than just snapping your fingers—you also need to plan ahead, comprehend your business’s demands, and be willing to explore other options.

Every funding method has its own peculiarities, such as the public appeal of crowdfunding and incubator mentoring. Although grants appear to be free money, there may be strong rivalry.

Although loans provide you freedom, the interest reduces your earnings. It might be difficult to navigate this jungle, but don’t worry!

Adapt your strategy to your unique requirements, whether you’re a baker looking for a little loan or a software genius in need of starting money. Recall that the correct amount of funding may take your company to new heights.

Click here for more informatic blogs regarding the businesses loans.